Form 7004 is the form used to file for an automatic extension of time to file your business tax returns for a partnership, a multiple member LLC filing as a partnership, a corporation, or s-corporation. You must file this extension by the due date of your business tax return. This is an automatic extension, so you will eligible for 6-months automatic extension of time to report your business return, however this automatic extension of time is just for report and not applicable for payment of tax bill.

Corporation tax returns are due by the 15th day of the 3rd month after the end of the tax year. For calendar year filers, this due date is March 15. If you cannot file on time, you can file an automatic tax extension form 7004, push your deadline from March 15th to September 15th,

Due Dates for Returns and Extension Applications

The due date for partnership and multiple-member LLC tax returns has changed. Partnership tax returns are now due on the 15th day of the third month after the end of your fiscal (financial) year. Since your partnership must end on December 31, the due date is March 15.

Tax return due dates vary by year. Extension applications for all business taxes must be filed by the tax return due date and taxes must be paid by the due date, even if an extension application is being filed. The taxes due must be estimated and the balance paid at the time the return is filed.

Corporate tax returns: Corporation tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the company’s fiscal (financial) year (effective with 2016 tax returns), on Form 1120. So, a corporation with a year-end date of December 31 must file and pay taxes by April 15.

Corporate tax returns: Corporation tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the company’s fiscal (financial) year (effective with 2016 tax returns), on Form 1120. So, a corporation with a year-end date of December 31 must file and pay taxes by April 15.

S corporation tax returns: S corporations must take a December 31 year-end to coincide with the tax return due date of the owners, so S corporation tax returns are due March 15, filed on Form 1120-S.

Partnership tax returns: Business tax returns for partnerships (including multiple-member LLC tax returns, which are considered as corporations) on Form 1065 are due March 15.

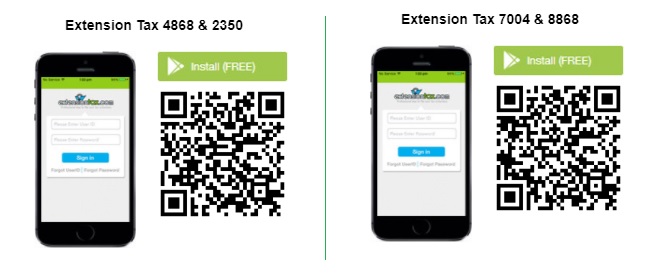

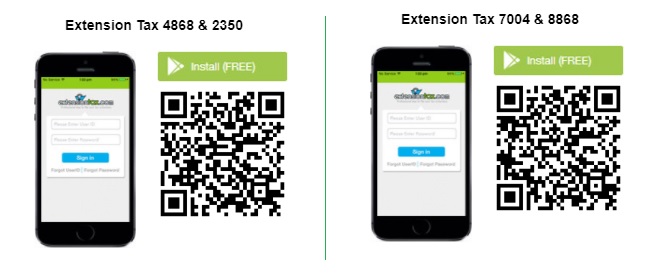

IRS authorized, economic e-File website to prepare and report all your business and personal income tax extensions online at @extensiontax, at an affordable price $9.99 only.